are car loan interest payments tax deductible

Are car lease payments tax deductible. Of course there is a caveat and its why most people cant use their loan payments as a tax deduction.

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be.

. More specifically if you borrowed money to buy a car you may well be asking are car loan payments tax deductible The answer to this is possibly but it depends on a number of. During Ronald Reagans time in office he reformed tax laws so that auto loan interest can no longer. But there is one exception to this rule.

However for commercial car vehicle and. It can also be a vehicle you use for both. May 10 2018.

You can deduct the interest paid on an auto loan as a business expense using one of two methods. If youre self-employed you will be able to write off a portion of your. But you can deduct these costs from your income tax if its a business car.

If you are an employee of someone elses business you are not eligible to claim this deduction. You actually should be able to. However you can write off a portion of your car loan interest.

Interest on car loans may be deductible if you use the car to help you earn income. Interest on loans is deductible under CRA-approved allowable motor vehicle. You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan.

If you bought this vehicle using a car loan you wont be able to write off your car payment. The car interest deduction is limited to self-employed taxpayers who pay interest on a car loan and use the vehicle for business purposes. Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes.

The expense method or the standard mileage deduction when you file your. Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest. Some of the expenses you may get a tax rebate for include operational expenses like fuel and oil repairs and servicing lease payments insurance premiums registration and.

The only exception to this rule is if your car is used for business purposes in which case you will qualify for a car. The answer to is car loan interest tax deductible is normally no. Answered on Dec 03 2021.

F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. You will be able to deduct car loan interest from your tax returns only if you own a car for business purposes. Typically deducting car loan interest is not allowed.

On a chattel mortgage like. Car lease payments are considered a qualifying vehicle tax deduction according to the IRS. With that being said there.

If you use your car for business purposes you may be allowed to partially deduct car loan. 30 of the taxpayers adjusted taxable income. The amount of car loan interest a self.

Up until 1986 it was possible for auto loan interest to be tax deductible. In most cases your car loan interest is not tax deductible. While you cannot deduct the 1500 payments you make on the principal loan amount you can deduct the 500 a month you pay in interest.

The same is valid for interest. Thats right your loan. In addition interest paid on a loan thats used to purchase a car solely for.

The taxpayers floor plan financing interest expense for auto dealers for example In putting this limitation in place the IRS also.

Auto Loan Calculator Moneygeek

Does Paying Off A Car Loan Early Hurt Your Credit Forbes Advisor

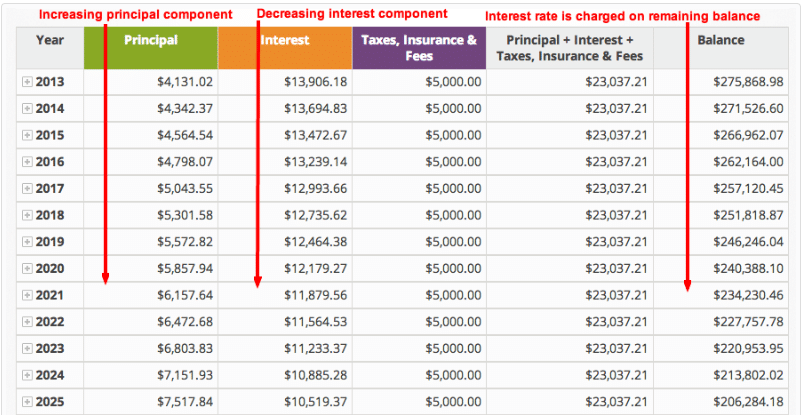

How To Calculate Amortization Expense For Tax Deductions

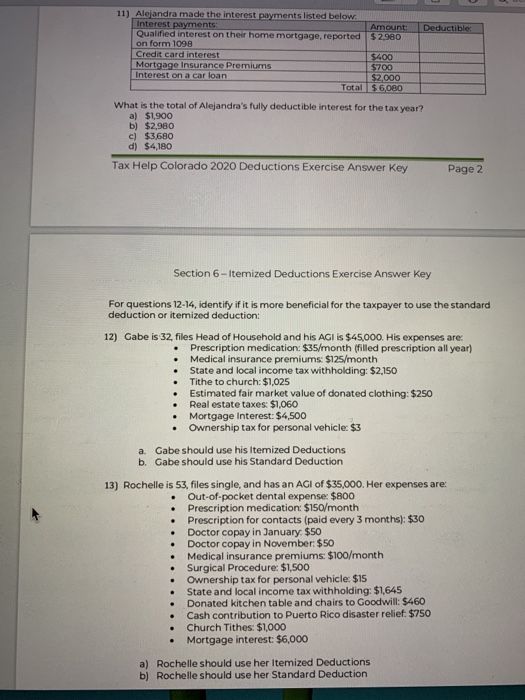

Solved 11 Alejandra Made The Interest Payments Listed Chegg Com

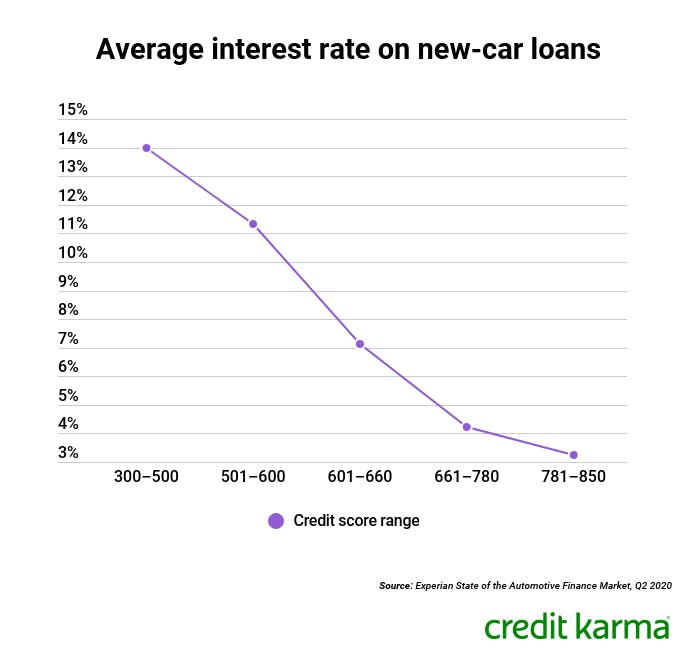

What Is A Good Interest Rate For A Car Loan Mercedes Benz Of Newton

Auto Loan Rate Forecast For 2022 Bankrate

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Business Use Of Vehicles Turbotax Tax Tips Videos

Solved Where To Enter Car Loan Interest

Claiming Car Loan Interest Property Tax Parking On Top Of Mileage

How Does Interest On A Car Loan Work Credit Karma

Car Loan Documentation Checklist 8 Things You Need Lendingtree

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

Average Auto Loan Payments What To Expect Bankrate

/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

Personal Loans Vs Car Loans What S The Difference

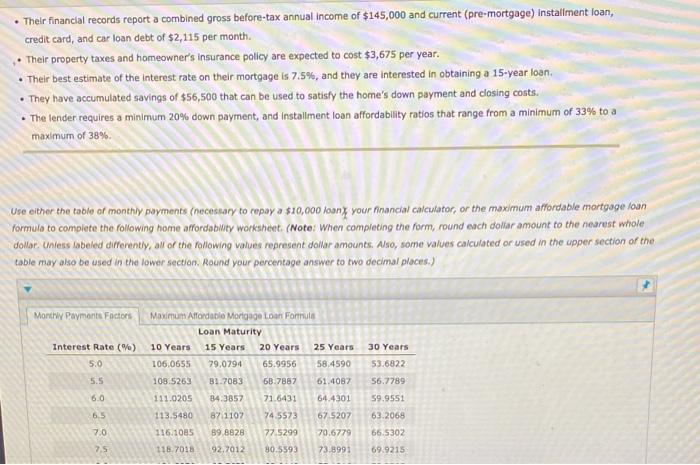

Solved Their Financial Records Report A Combined Gross Chegg Com

Business Loan Interest Tax Deduction What Small Business Owners Need To Know Nerdwallet